For many Canadians, a mortgage is one of the most significant financial commitments they'll make in their lifetime. Yet, how many truly understand the intricacies of their mortgage interest? The monthly mortgage payment you make is a combination of both interest and principal repayment. Grasping the nuances of your mortgage's amortization schedule, and the impact of its length on the total interest paid, is crucial for every homeowner.

Let's delve into an example to illustrate this:

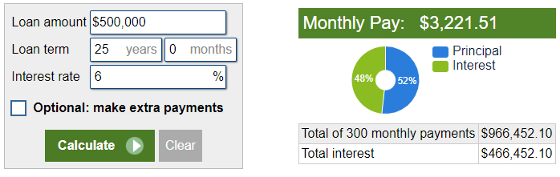

Imagine you have a remaining mortgage loan amount of $500K, with an interest rate of 6% and an amortization period of 25 years. Over this term, you'd end up paying approximately $466K in interest alone.

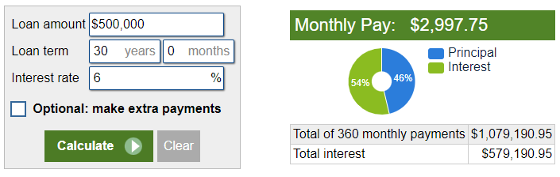

Now, some might consider extending their amortization period to 30 years to reduce their monthly payments. However, this decision comes at a cost. Using the same loan parameters, but with a 30-year amortization, the total interest balloons to around $589K.

From this, it's evident that extending the loan term can significantly increase the total interest paid. In today's climate of rising interest rates, it's more prudent than ever to strategize ways to pay off your mortgage sooner.

Strategies to Consider:

Annual Prepayments: Most Canadian banks permit homeowners to prepay 15-20% of their loan amount annually. This directly reduces the principal amount, saving you on interest in the long run.

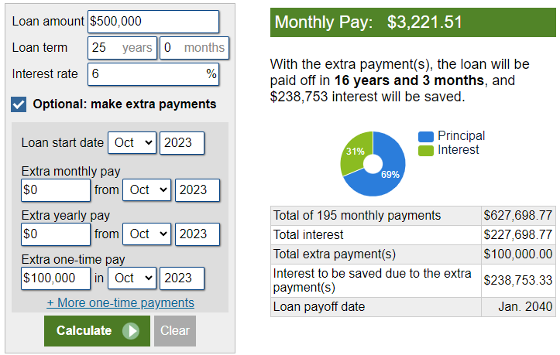

One-Time Significant Payment: If you can manage it, making a one-time payment of $100K can be a game-changer. This strategy could save you a whopping $238K in interest, allowing you to clear your mortgage in just 16 years.

In conclusion, while mortgages are a necessary tool for homeownership, understanding the mechanics behind them is vital. By being informed about interest rates and amortization schedules, you can make decisions that save you money and bring you closer to a debt-free future.

------------------------------------------------------------------------------------------------------------------

About the Author:

Ajay Sandhu, your trusted Real Estate professional at Real Professionals Inc., is also a Mortgage Associate with Mortgage Alliance. With extensive experience as a real estate investor, Ajay brings a wealth of knowledge about diverse investment strategies to the table. He takes immense pride in serving the Greater Calgary Area, helping clients make informed decisions and achieve their real estate and financial goals. Whether you're buying, selling, or seeking mortgage advice, Ajay is your go-to expert for a seamless and successful real estate journey.